Our collaboration with new Spaces to Places UK Flex Office Market 2025 report

18th March, 2025

We’re incredibly proud to support the new Spaces to Places UK Flex Office Market 2025 report, which provides an in-depth analysis of the sector, along with key insights into the industry’s ever evolving landscape.

The UK flex office market is experiencing a transformative period, with flex spaces now accounting for approximately 10% of London office space. This insightful report examines the market dynamics, business models, and growth opportunities in this evolving sector.

At DBSJ, we understand the office fit-out industry is under increasing pressure to create exceptional environments that truly resonate with employees and truly reflect brand values.

With a unique UK-wide integrated fit-out offering – Design, Build, Shopfit, Joinery – we have established a reputation as a partner for combining creative flair with practical delivery.

Proud to be winners of the 2024 Construction News Fit Out Specialist of the Year, DBSJ has seen significant growth in the flexible office fit-out sector, delivering 26 projects across the UK for IWG and its franchise partners across its Spaces, Signature, and Regus brands in the last two years. From refurbishments to new centre openings of up to 47,000 sq ft, our award-winning work fosters collaboration to create exceptional interiors for teams to thrive together.

UK Flex Office Market 2025 report key findings

Market structure: The sector comprises 52 brands with 10+ locations. IWG’s Regus remains the market leader with 196 locations, representing 16% of the top 52 providers’ locations.

Business models: There are four main routes to market, with the growing adoption of a hybrid Management Agreement and Lease model. Providers tend to take an agnostic approach to models, adapting based on market dynamics, building characteristics, and ownership.

Market Dynamics: The pandemic accelerated polarisation in the sector. Newer entrants focus on premium, hospitality-led, and management agreement models, while established, property-led providers prioritise ownership and value-driven offerings. Among the providers analysed with 10+ locations, the average business age is 23 years, reflecting the sector’s evolution. This divide underscores market growth, with emerging brands and ‘Brandlords’ reshaping workspace experiences to meet shifting demands.

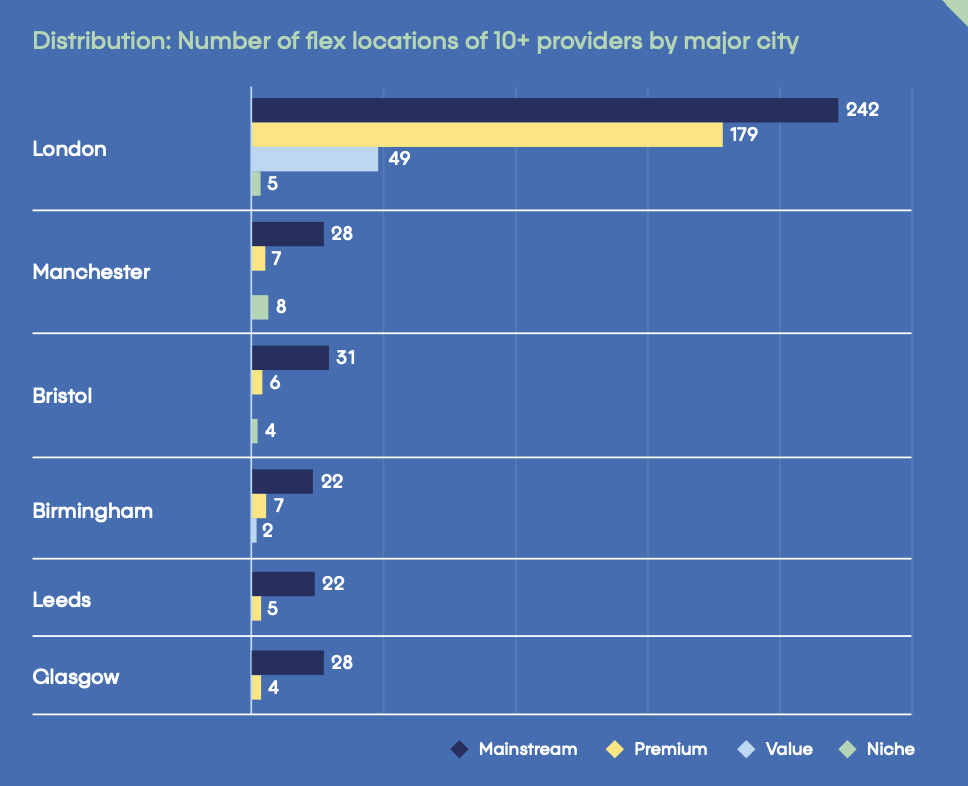

Regional distribution: 46% of key players maintain a presence in both London and regional markets, while 39% focus exclusively on regional locations and 15% operate solely in London.

Delve deeper into the insightful UK Flex Office Market 2025 report’s findings.

Are you looking to transform your space into an exceptional flex office that supports productivity, collaboration and well-being? We can help you.